AI-Powered Cyber Insurance Technologies

That Drive Growth

Cyberwrite combines patented cyber insurance machine learning analytics with CyGPT, our AI-powered decision engine, to deliver advanced underwriting intelligence, broker enablement, and next-generation cyber catastrophe modeling. Insurers, reinsurers, and brokers gain clear, explainable insights to assess cyber exposure, manage accumulation risk, support client advisory, and make faster, more confident underwriting and portfolio decisions.

TRUSTED BY INDUSTRY LEADERS

Understanding cyber insurance risk is complicated. We make it easy.

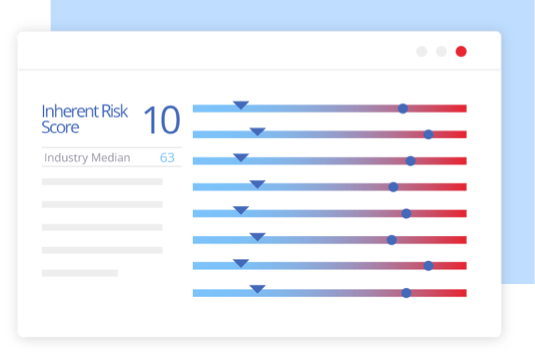

Designed for cyber insurance

Unparalleled Accuracy

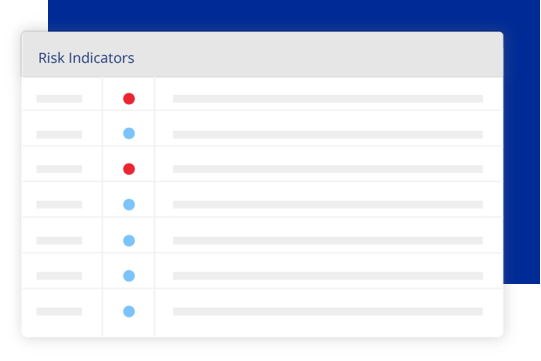

Deep Insight

Broad Scope

Tailored to Coverage

Global Reach

REAL-WORLD IMPACT

320m+

Data in less than a minute on 320M+ businesses

80K+

Cyber Catastrophe Modeling Event Set

One platform to accelerate value across the cyber insurance lifecycle

For insurers

Increase Underwriting Profitability

Reduce underwriting costs and achieve record-low loss ratios with faster, more consistent underwriting decisions.

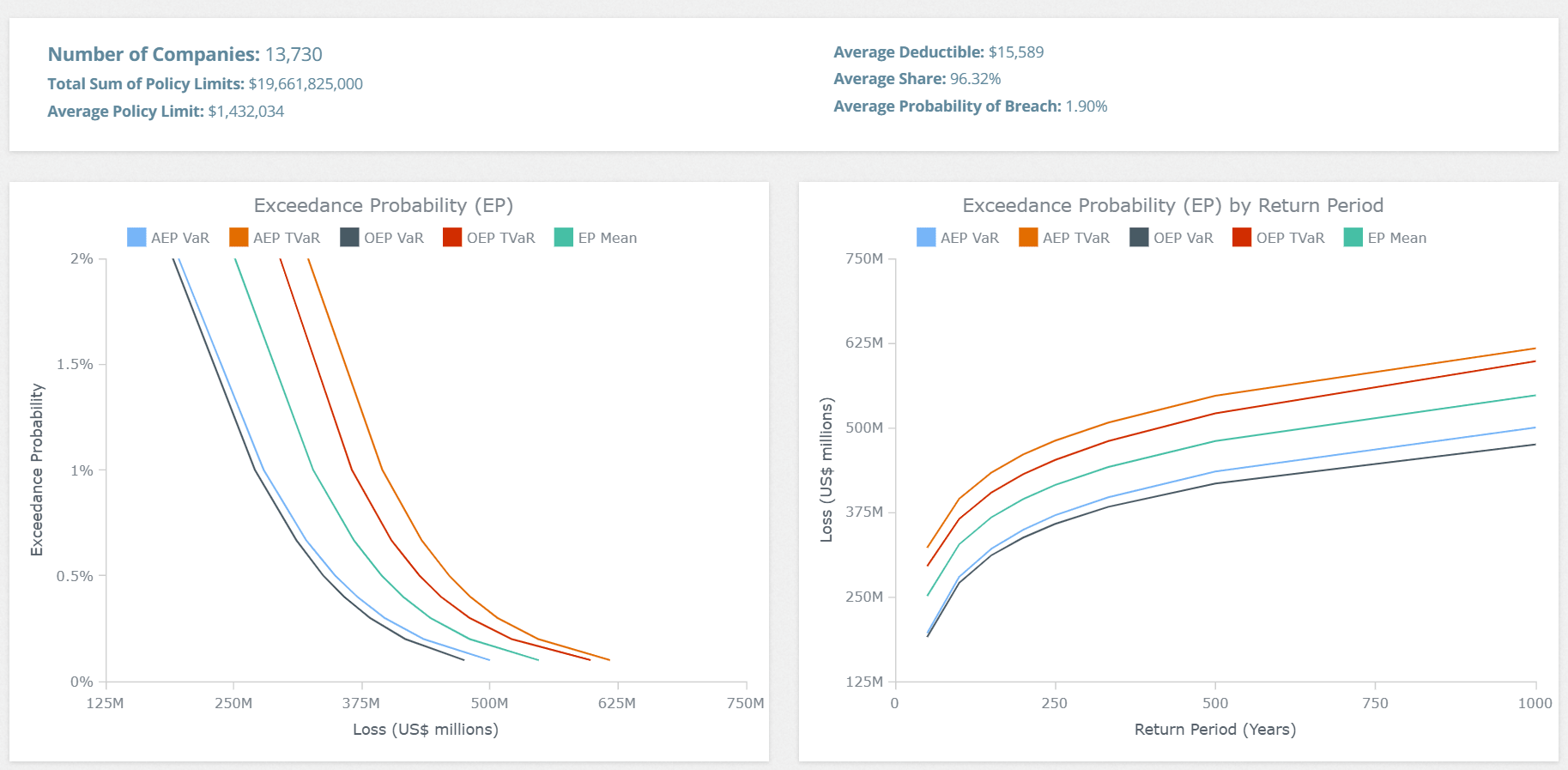

Improve Catastrophe Modeling

Gain greater visibility into your organization’s aggregated risk exposure and ongoing monitoring of each company’s risk.

Boost Distribution Efficiency

Better target sales efforts with cyber risk insights on any business, at any time.

Empower Insureds

Provide insureds with actionable insights to reduce their cyber risks and mitigate losses when cyberattacks do occur.

For reinsurers + Lloyd’s Syndicates

Data-Driven Catastrophe Modeling

Get the cyber insurance risk data you need for every company across your portfolio to improve catastrophe modeling and risk management.

Ensure Global Consistency

Provide easy-to-understand cyber risk reports to your cedent companies to ensure consistency in underwriting.

Empower Insureds

Provide insureds with actionable insights to reduce their cyber risks and mitigate losses when cyberattacks do occur.

Catastrophe Modeling

Cyberwrite’s next-gen catastrophe model uses granular data on every risk to assess breach probabilities and potential damages accurately.

For brokers & MSSP’s

Grow Your Business

Become a trusted cyber risk advisor with personalized cyber insurance risk reports on any business in seconds to help your clients understand their cyber risks

Accelerate Sales

Drive adoption with ability to provide clients in real-time a clear understanding of the potential financial impact of a cyberattack on their business.

Empower Your Clients

Provide insureds with actionable insights to reduce their cyber risks and mitigate losses when cyberattacks do occur.

Reduce E&O Risks

Easily highlight the minimum coverage recommended to show clients why they need cyber insurance coverage.