Next-Generation Catastrophe Modeling:

Data-Driven, Transparent, and Flexible

Bridging Cedents and Capacity Providers with Comprehensive, Data-Driven Technology

In the complex world of cyber insurance, clarity and trust are essential. Cyberwrite’s next-generation catastrophe model bridges the gap between buyers and sellers by delivering transparent, data-driven insights that both parties can rely on. With high-resolution data and consistent, repeatable analytics, Cyberwrite empowers insurers to confidently communicate risk and accurately assess portfolios. This alignment fosters a clear, mutual understanding of cyber risk, making Cyberwrite the optimal tool for facilitating confident decision-making, fair negotiations, and successful partnerships in a rapidly evolving market.

Contact us now for a demo

Key Benefits

Cyberwrite collects data on each and every risk in the book of business, calculating both the inherent risk score and potential economic impact with a global coverage exceeding 99.97%. This vast, granular data enables us to deliver catastrophe models with unmatched transparency, empowering insurers with clear, data-driven analysis. By leveraging this level of detail, Cyberwrite provides insurers the unique ability to compare books of business seamlessly at the time of underwriting, setting a new standard for accuracy and insight in catastrophe modeling.

- Accelerated Decision-Making Speed: Rapid, data-driven insights delivered in minutes.

Efficiency: Streamline underwriting and exposure management.

Confidence: Empowered, consistent decisions in real-time with high-speed analytics. - Proactive Exposure Management Transparency: Fully understand your exposure with flexible, transparent insights.

Flexibility: Manage changes in risk across scenarios, keeping you ahead of emerging threats.

Control: Seamless adjustment to risk levels, ensuring stability and clarity. - Unleashing Growth in Cyber Insurance Scalability: Access the full market potential with Cyberwrite’s transparent, flexible framework.

Adaptability: Adjust assessments as threats evolve, seizing profitable opportunities.

Clarity: Benefit from enhanced visibility into risk, tailored for the insurance industry.

Cyber Exposure Management, Redefined

- Consistent Results for Confident Decisions Reliability: Consistency across scenarios, ensuring accuracy in decision-making.

Transparency: View exposure changes over time with clear, repeatable analytics.

Regulatory Alignment: Ensure seamless compliance with regulatory benchmarks. - Transparent Insights for Exposure Clarity Visibility: Detailed insights into drivers of exposure.

Simplicity: Easy-to-track impacts of risk changes for stakeholders.

Precision: Drill down on data to understand exposure dynamics across portfolios. - Accurate Modeling to Keep Pace with Evolving Threats Real-World Alignment: Use high-resolution data to capture accurate, timely risks.

Continuous Improvement: Our model adapts to reflect current industry and threat landscapes.

Customization: Tailor the model to meet both long-term and real-time portfolio needs.

A Consistent and Accurate Approach to Modeling

Cyberwrite’s model ensures that running the same data produces consistent results. Accuracy is maintained with up-to-date insights on each company within the portfolio, ensuring that exposure data remains clear and manageable across model versions:

- Consistency Identical input, identical output—reliable across model updates

- Accuracy A data drive approach means a better way to distinguish between risks, ensuring more accurate portfolio management.

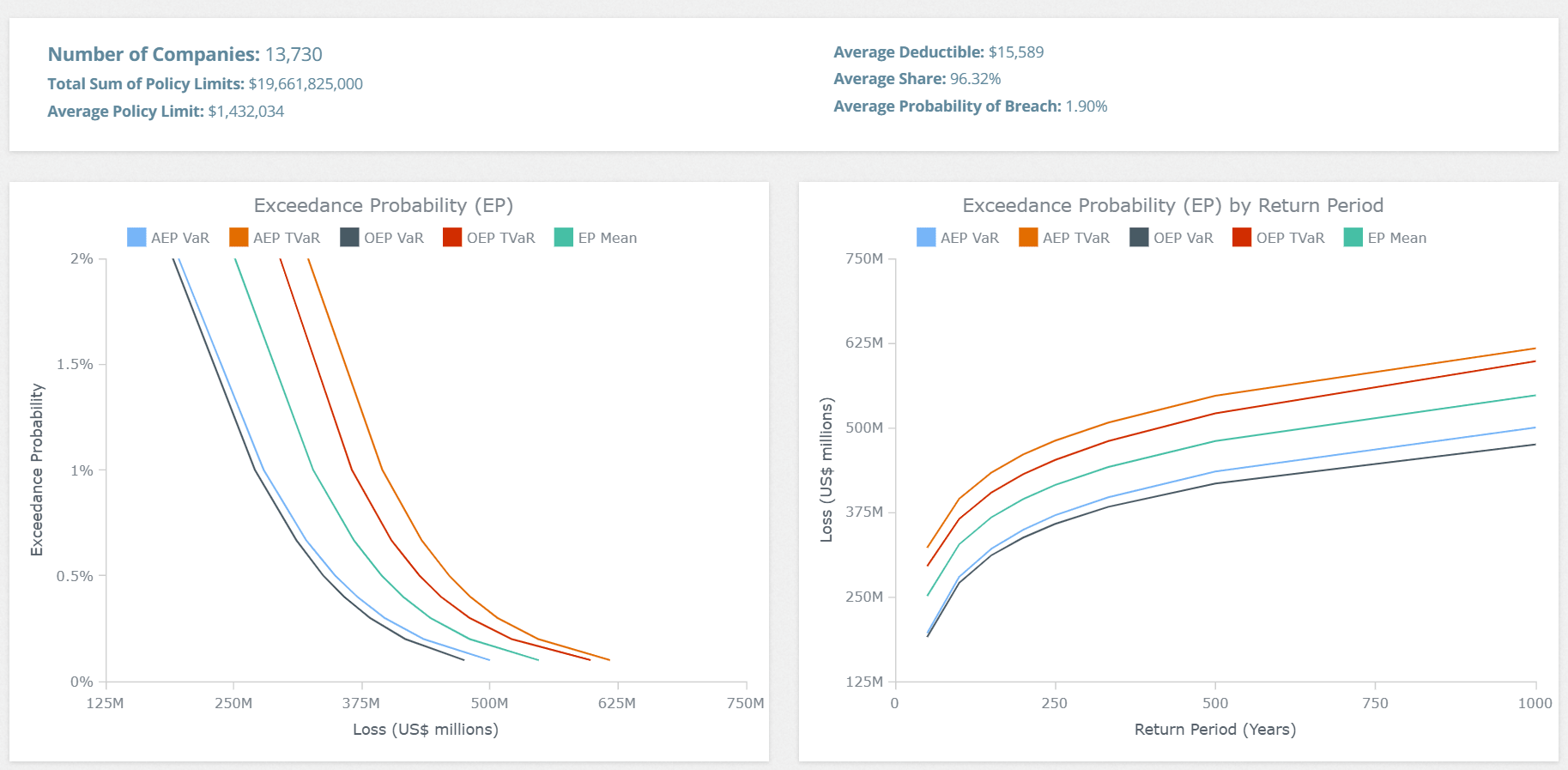

With Cyberwrite, you can identify exactly how changes impact the Exceedance Probability (EP) curve and link exposure management directly to results.

A Three-Step Process for Cyber Exposure Management

- 1. Gather Insights Access high-resolution data on the portfolio

- 2. Analyze Exposures Gain granular insights into risk drivers

- 3. Generate EP Curves Understand accumulation potential with precise return period data.

Cyberwrite’s cycle allows for validation, challenge, acceptance, and day-to-day use, with transparent exposure management for regulatory and business confidence.

Key Features

- High-Resolution Data Distinguish inherent and residual risks with unparalleled granularity.

- Transparency Full visibility into data, assumptions, and methodology

- Fast Analytics Rapid insights, with catastrophe modeling powered by advanced tech

- Reliable Financial Modeling Detailed risk views from ground-up to reinsurance loss

- Global Solution Reflect global risk correlations with worldwide data insights

For ILS markets: Cyberwrite’s next-gen catastrophe model minimizes model risk by avoiding rigid scenario segmentation, offering a more accurate view of event footprints based on real data. This approach also supports synthetic loss triggers, making our model an ideal choice for parametric solutions. Designed with transparency, Cyberwrite’s model bridges the gap between sponsors and investors, ensuring that both parties—who often have differing expectations on returns—can reach a fair agreement based on clear, consistent insights.